The prominent venture capital firm Andreessen Horowitz, commonly known as a16z, has intensified its search for high-potential technology startups across Europe. The firm’s partners are actively deploying capital and establishing a local presence to identify promising companies at their earliest stages. This strategic move positions a16z to compete directly with established regional investment funds for access to Europe’s next generation of innovators.

Global Strategy for Local Discovery

According to statements from the firm, a16z has built a worldwide network to spot emerging companies as early as local investors might. The firm’s strategy involves maintaining a constant, ground-level presence in key innovation hubs beyond its Silicon Valley headquarters. This approach allows its investment teams to gain insights into regional market dynamics and founder communities before many companies formally seek funding.

The expansion reflects a broader trend of major U.S.-based venture capital firms increasing their activity in European markets. Over the past decade, Europe’s startup ecosystem has matured significantly, producing several technology companies valued at over one billion dollars, commonly referred to as unicorns. Sectors such as fintech, enterprise software, artificial intelligence, and climate technology have shown particular strength in the region.

Building a European Presence

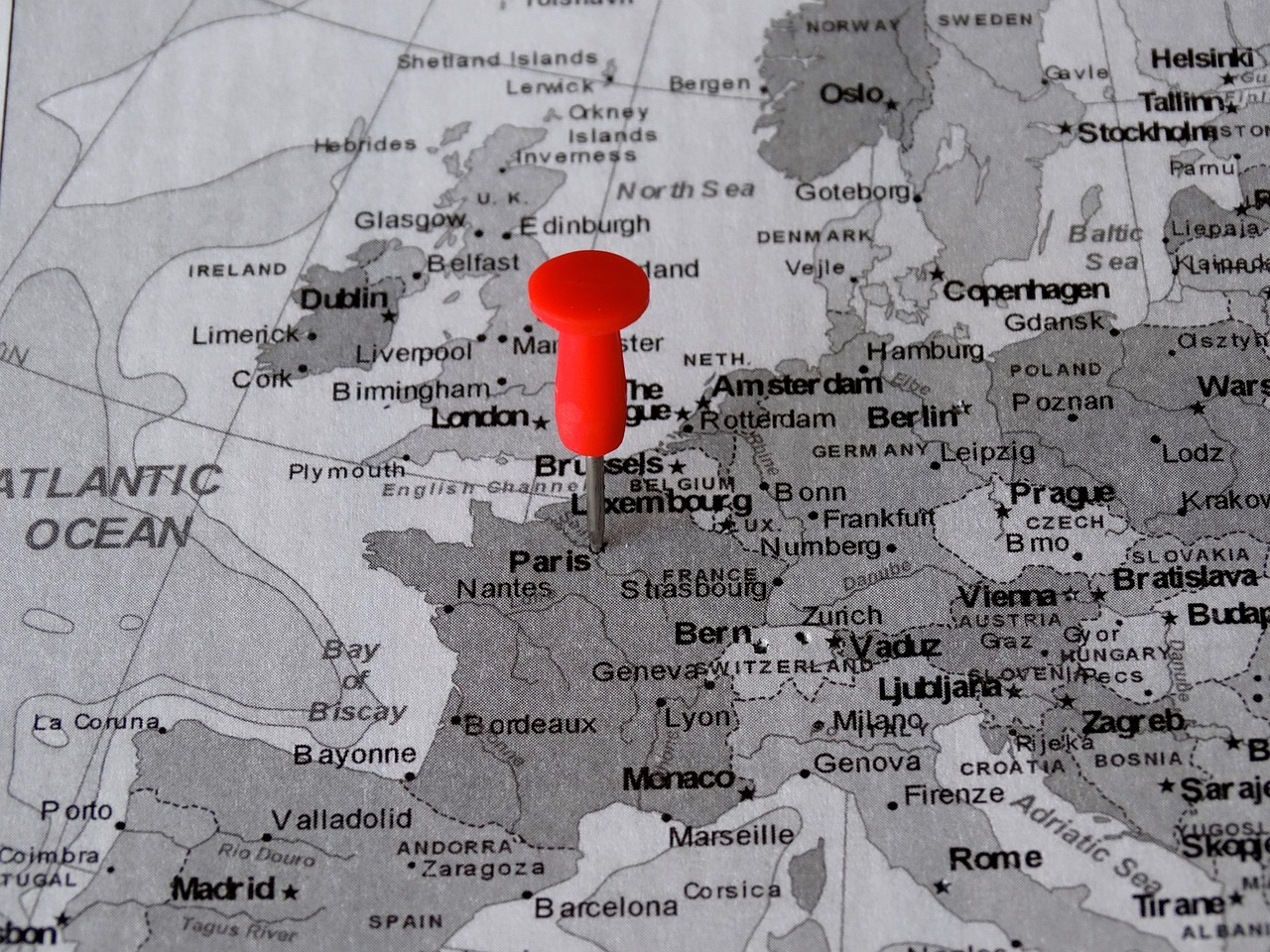

To execute this strategy, a16z has been hiring investment professionals with deep expertise in European markets. The firm has also been hosting and participating in local events, founder workshops, and networking forums. This on-the-ground activity is designed to build relationships and trust within entrepreneurial communities across major cities like London, Berlin, Paris, and Stockholm.

The firm’s increased focus does not represent the launch of a dedicated European fund. Instead, it signifies a more coordinated effort to source deals for its existing, large-scale global funds. This method allows a16z to leverage its substantial resources and operational expertise to support European founders who are building companies with global ambitions from their inception.

Competitive Landscape for Early-Stage Deals

a16z’s deepened commitment places it in direct competition with Europe’s own thriving venture capital scene. Numerous successful local and pan-European funds have historically provided the initial capital and mentorship for the region’s startups. These funds often benefit from long-standing local networks and specialized knowledge of regulatory and commercial environments.

Industry analysts note that the presence of a firm with a16z’s reputation and check-writing ability can raise the profile of the entire European tech sector. It can also lead to increased valuation benchmarks and more substantial funding rounds for top-tier companies. However, some observers caution that intense competition for a limited number of elite deals could increase market pressure on early-stage valuations.

Future Outlook for European Tech Investment

The firm’s activities are expected to continue accelerating throughout the coming year. a16z will likely announce further investments in European startups across various technology verticals. The long-term impact of this sustained attention from one of the world’s most influential venture firms on the European ecosystem’s development remains a key point of observation for the global investment community.

Source: GeekWire